The Hidden Truth That's Keeping Lottery Winners Up At Night

"Should I tell my family?" "How do I protect my privacy?" "Why do so many winners end up broke or worse?" These questions haunt lottery winners because what you don't know about managing a windfall isn't just frustrating – it could be putting your newfound wealth at SERIOUS RISK!

WARNING: Don't Sign That Ticket Yet!

Your first instinct might be to sign your winning ticket immediately – but lottery attorney Kurt Penucci warns this could be a catastrophic mistake that limits your options for privacy protection and tax planning. What you do in the first 24 hours after winning can make or break your financial future.

Did you know that 70% of lottery winners lose everything within five years? Or that some winners face even worse outcomes due to privacy breaches, legal disputes, and poor financial decisions? The reality of winning a lottery jackpot is far more complicated than most people realize.

The Critical First 24 Hours: Do This Before Anything Else!

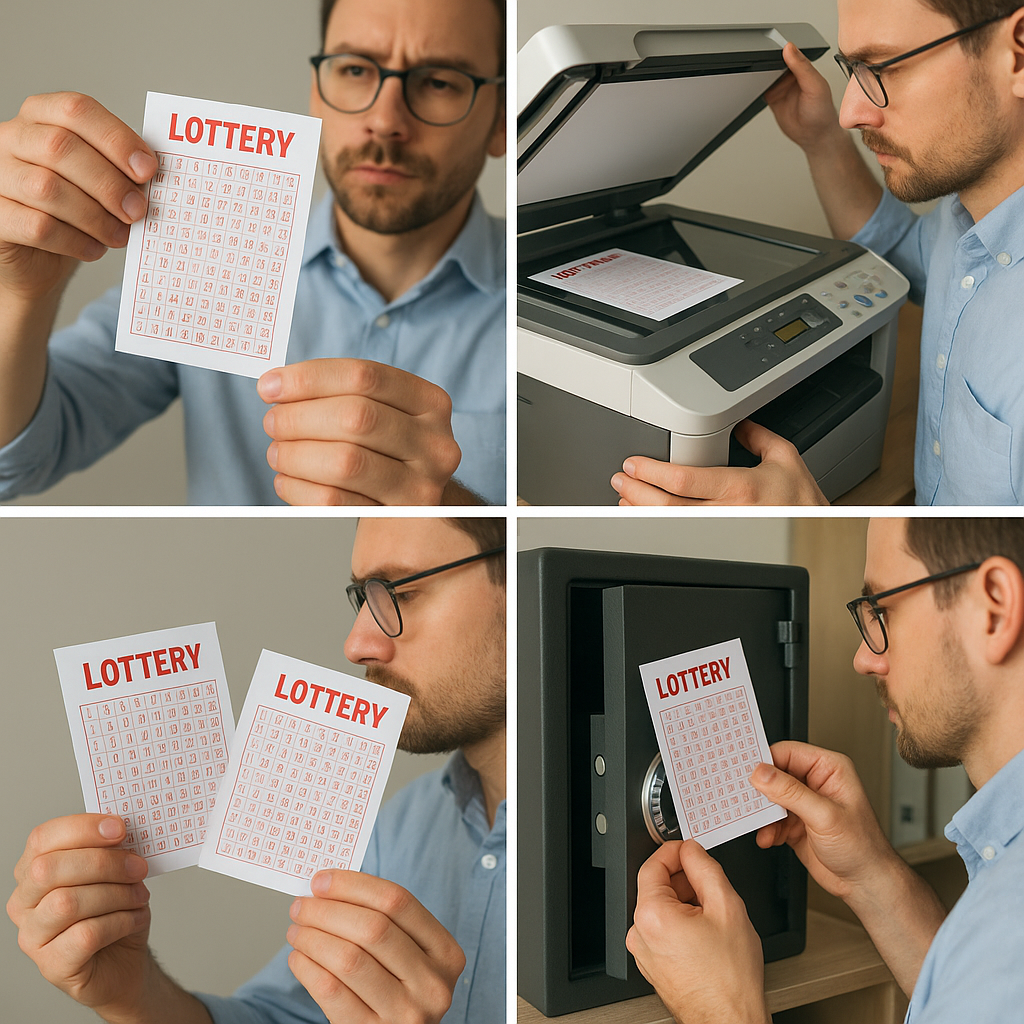

STEP 1 "Secure Your Golden Ticket"

DO NOT sign your ticket immediately. Instead, take these crucial steps to protect your winning ticket and your future options:

- Make multiple copies of both sides of the ticket

- Take a selfie with the ticket (proof of possession)

- Store it in a secure location (safe deposit box recommended)

STEP 2 "Call a Specialized Lottery Attorney First"

Before telling anyone – even family – contact a lottery attorney who can:

- Provide crucial emotional support during this overwhelming time

- Create legal structures to shield your identity

- Develop a strategic claiming plan that maximizes your options

STEP 3 "Maintain Complete Silence"

Resist the urge to share your exciting news. Each person you tell:

- Increases the risk of your win becoming public knowledge

- May become a potential source of requests for money

- Could inadvertently complicate your claiming strategy

Anonymity Protection: The #1 Defense Against Financial Predators

The moment your name is associated with a lottery jackpot, you become a target for financial predators, scammers, frivolous lawsuits, and endless requests for money. Your privacy is your most valuable asset after winning.

REVEALED: State-by-State Anonymity Options

Your ability to remain anonymous varies dramatically depending on where you purchased your ticket. Kurt Penucci explains the three types of states:

| Anonymity Level | States | Protection Options |

|---|---|---|

| Full Anonymity | Delaware, Kansas, Maryland, North Dakota, Ohio, South Carolina, Texas, others | Winners can remain completely anonymous by law |

| Partial Anonymity | Arizona, Georgia, Virginia, others | Limited-time anonymity or high-value threshold requirements |

| No Direct Anonymity | California, Wisconsin, others | Public records laws require disclosure, but legal structures may provide protection |

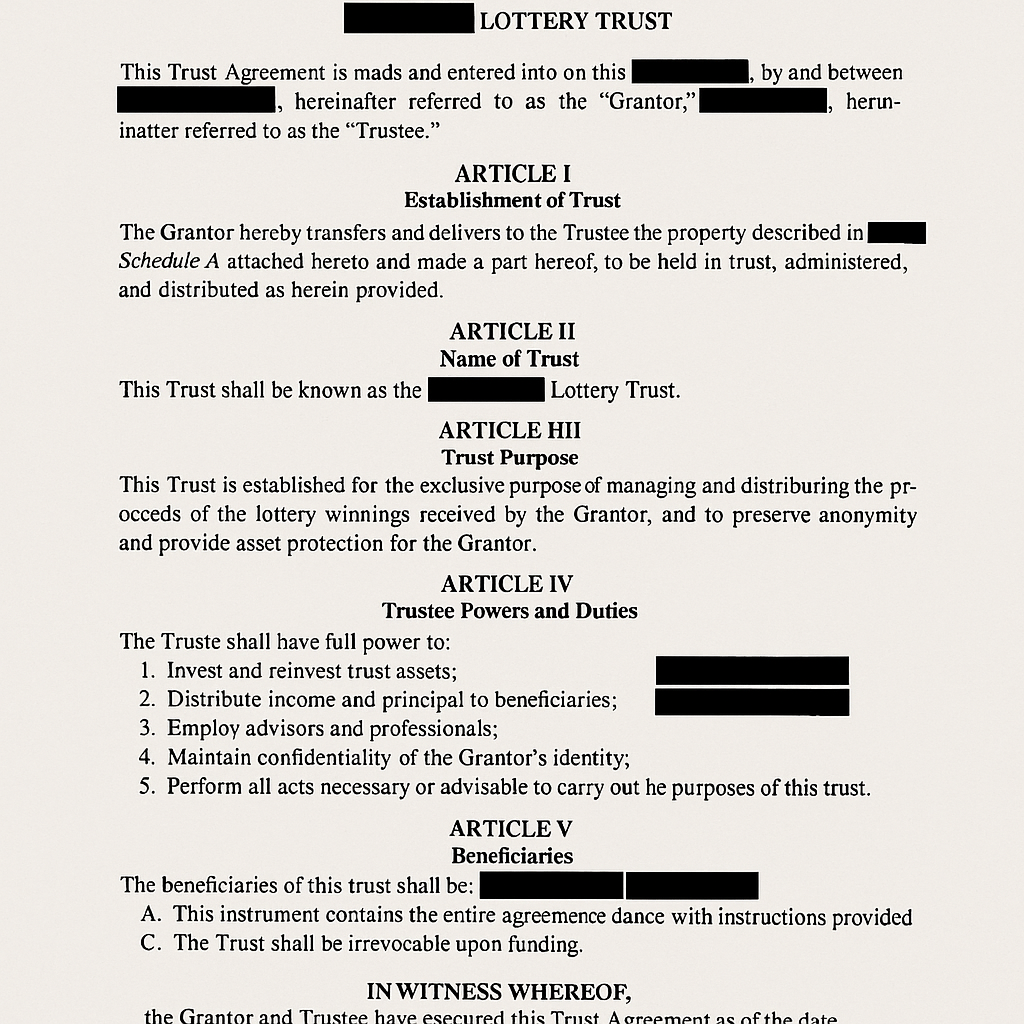

SECRET "Legal Structures That Shield Your Identity"

Even in states with strict public disclosure laws, these legal structures can provide crucial protection:

- Blind Trusts - Allow trustees to act on your behalf without revealing you as the beneficiary

- Limited Liability Companies (LLCs) - Create a legal entity to claim the prize instead of using your personal name

- Multi-Tiered Entities - Complex structures that add additional layers of privacy protection

Lump Sum vs. Annuity: The Million-Dollar Decision Most Winners Get Wrong

One of the most significant financial decisions you'll face is choosing between a one-time lump sum payment or an annuity paid out over many years. This choice affects everything from tax liability to long-term financial security.

TRUTH "The Lump Sum Reality Most Winners Don't Understand"

That advertised "$500 million jackpot" may only provide $300 million or less as a lump sum - and that's before taxes take another 40-50% of that amount!

Lump Sum Advantages

- Immediate access to full (reduced) cash value

- Investment control and potential for higher returns

- Protection against future tax rate increases

- Avoids risk of lottery commission insolvency

- Complete estate planning flexibility

Lump Sum Disadvantages

- Significantly lower than advertised jackpot amount

- Maximum tax impact in a single year

- Greater risk of mismanagement or depletion

- More likely to attract immediate financial predators

- No guaranteed income stream for life

Annuity Advantages

- Receives full advertised jackpot amount

- Spreads tax burden across many years

- Built-in budget discipline and protection

- Steady income regardless of market performance

- Less overwhelming to manage initially

Annuity Disadvantages

- Money loses value to inflation over time

- Limited investment control

- Restricted access to full funds

- Exposure to future tax increases

- Payments may not pass fully to heirs

EXPERT ADVICE: Get Professional Guidance Based on YOUR Situation

According to Kurt Penucci, this decision should be made only after careful consultation with financial experts who can analyze your specific circumstances, including your age, investment experience, financial goals, and even personality traits that might affect your ability to manage a large sum responsibly.

Tax Strategies That Could Save You MILLIONS

Few winners realize that strategic tax planning could save them millions in unnecessary taxes. The federal government takes up to 37% of lottery winnings, and state taxes can add another 0-13% depending on where you live.

STRATEGY "Timing Your Claim for Maximum Tax Advantage"

Claiming in January versus December provides almost a full year to implement tax strategies before your payment is reported as income. This timing difference alone could save millions on large jackpots.

LEGAL "The Team Claiming Approach"

Including family members in the initial claim can utilize multiple gift tax exemptions (up to $17,000 per recipient annually tax-free). This strategy must be implemented before claiming the prize to be effective.

CAUTION "State Residency Considerations"

Moving to a no-income-tax state before claiming (where legally possible) could save millions in state taxes. However, this strategy requires careful planning and documentation to avoid tax fraud allegations.

WARNING: Don't Try These Strategies Without Professional Guidance

Tax planning for lottery winners requires specialized knowledge. Attempting these strategies without proper legal and financial guidance could result in serious tax penalties or even criminal charges for tax evasion.

Avoiding the "Lottery Curse": Why Winners Go Broke

The "lottery curse" isn't a myth – studies show that a significant percentage of major lottery winners eventually declare bankruptcy or lose their fortune. Understanding why this happens is the first step in avoiding this fate.

DANGER "The 5 Financial Traps That Destroy Lottery Winners"

- Extravagant Spending - Purchasing multiple homes, vehicles, and luxury items without considering ongoing costs

- Poor Investment Decisions - Falling victim to high-risk investments, scams, and unqualified advisors

- Unsustainable Gifting - Depleting funds through excessive generosity to family and friends

- Lack of Budgeting - Failing to establish spending limits appropriate to the actual after-tax amount

- Isolation and Psychological Issues - Struggling with changed relationships and identity

ESSENTIAL: Your Financial Dream Team

Kurt Penucci emphasizes that protecting your windfall requires professional expertise from the beginning. Here are the critical team members you need:

| Team Member | Role | Selection Criteria |

|---|---|---|

| Lottery Attorney | Legal protection, claiming strategy, anonymity | Experience with high-value lottery winners |

| CPA/Tax Professional | Tax strategy, compliance, reporting | Expertise in high-net-worth clients and windfall taxation |

| Financial Advisor | Investment management, wealth preservation | Fiduciary duty, fee-based (not commission), substantial experience |

| Estate Planning Attorney | Long-term asset protection and succession planning | Experience with significant estates and complex trusts |

Office Pool Nightmares: The Legal Time Bomb That Could Cost Everything

Office lottery pools are popular but fraught with potential legal complications when a winning ticket is involved. These situations have led to some of the most contentious lottery-related lawsuits, with colleagues fighting over millions in court for years.

PROTECT "Creating Legally Sound Pool Agreements"

To protect all participants, Kurt Penucci recommends implementing formal agreements that address:

- Membership documentation - Clear records of who contributed to each drawing

- Contribution tracking - Amounts paid and collection dates

- Ticket purchasing procedures - Who buys tickets and how they're safeguarded

- Prize distribution method - How winnings will be claimed and divided

- Contingency plans - Procedures for missing participants or disputed contributions

SIMPLE SOLUTION: Document Everything

"Even informal office pools should have basic written agreements and photocopy all tickets, distributing copies to all participants before drawings. This simple step can prevent devastating disputes if a winning ticket emerges."

🔥 This is Amazing! He Won the Lotto Jackpot 7 Times, and Doesn’t Mind Revealing His Secrets... 🔥

For a limited time, get "The Lottery Winner's Survival Guide" – the complete resource Kurt Penucci recommends to all potential and actual winners.

Don't let your dream win become a nightmare. Prepare yourself with expert knowledge before you need it!

Get Your Lottery Winner's Survival Guide Today!Before your ticket hits the jackpot!

Expert Answers to Your Most Urgent Questions

What should I do immediately after winning the lottery?

Do not sign your ticket immediately. Make copies of the ticket, take a selfie with it, and secure it in a safe place. Then contact a lottery attorney before anyone else, even family members. This approach preserves your options for anonymity and proper financial planning.

Is it better to take the lump sum or annuity payment?

This depends on your individual circumstances. A lump sum gives you immediate access to all the money (minus taxes) while an annuity provides regular payments over time. Both have different tax implications and financial planning considerations. The right choice varies based on your age, investment experience, financial goals, and personal financial discipline.

How can I remain anonymous after winning the lottery?

Anonymity options vary by state. Some states allow winners to claim through trusts or LLCs, while others have specific laws protecting winner identity. A lottery attorney can help navigate these options based on your state's laws. Even in states that require public disclosure, legal structures can provide significant privacy protection.

What are the tax implications of winning the lottery?

Lottery winnings are subject to federal income tax (up to 37%) and potential state income taxes (0-13% depending on your state). Different payout options and strategic planning can impact your tax burden significantly. Strategic timing of your claim, proper use of gift tax exemptions, and other approaches can help minimize your tax liability.

Why do so many lottery winners go broke?

Many winners make poor investment decisions, overspend without a budget, face increased requests from family and friends, and lack proper financial planning. Working with financial professionals and maintaining anonymity can help prevent these issues. Psychological factors also play a role - sudden wealth can lead to poor decision-making and difficulty adjusting to new financial realities.

How should I handle an office lottery pool to prevent disputes?

Create a written agreement that documents participants, contributions, and distribution plans. Photocopy all tickets and share with all pool members before each drawing. If a win occurs, consult with a lottery attorney before claiming. These simple steps can prevent years of costly litigation and destroyed relationships if your pool hits the jackpot.

How long do I have to claim a lottery prize?

Claim periods vary by state and range from 90 days to one year. However, claiming immediately is rarely advisable. Most lottery attorneys recommend taking time to establish proper legal and financial structures before coming forward. Just be sure to securely store your ticket and keep track of the claim deadline for your state.

Protecting Your Lottery Fortune: The Final Word

Winning the lottery represents a life-changing opportunity that requires careful management to transform into lasting financial security. By following expert advice—maintaining anonymity, assembling a qualified professional team, making informed payout decisions, and implementing sound financial planning—winners can avoid the pitfalls that have plagued many before them.

REMEMBER: The Most Important Decision You'll Make

"The difference between lottery winners who thrive and those who lose everything often comes down to the decisions made in the first few days and weeks after the win. Professional guidance from the beginning is the single most important factor in long-term success."

Whether you've just discovered a winning ticket or are planning ahead for a potential win, the strategies outlined in this guide provide a roadmap for protecting your lottery fortune and enjoying the financial freedom it can provide.